Kenyan digital loan app

MoKash is a free-to-use financial app designed to help Kenyans get the emergency funds they need when they need them. This digital loan platform from the fintech company of the same name promises a full-online application process, with quick approval times for eligible users. With flexible loan amounts from 1,000 to 30,000 Kenyan Shillings (KSh), locals can have quick loans with a flexible repayment period.

Top Recommended Alternative

In terms of the app, MoKash doesn’t reinvent the online lending space, but it is mostly reliable as an app. It works a lot like EaseMoni—Instant loan online or Personal Loan App Online Loan - KreditBee.

Helping Kenyans access emergency funds

The first catch about MoKash is that it’s only available for Kenyan residents. Users need to register for an account before they can apply for loans. However, unlike other online lending apps operating in the country, this one is a bit easier to get into. It doesn’t require a lot of documents, just the Kenyan National ID and an M-Pesa account for faster fund disbursement.

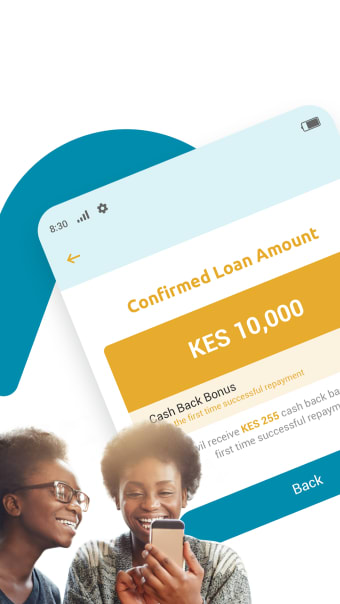

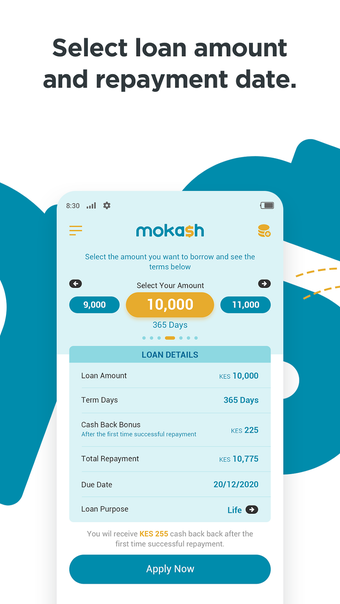

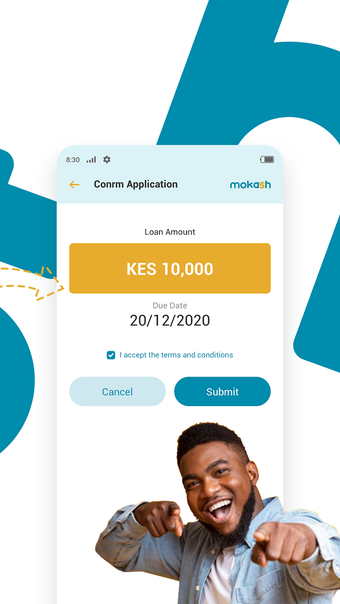

For the app, it uses a simple layout that is quite easy to use. Once the account has been successfully registered and verified, users can start taking out loans. As mentioned, loan amounts vary from 1,000 to 30,000 KSh, with a two-week processing period. Paying your loan is also quick and easy, with transactions facilitated via the M-Pesa platform.

One detail worth noting is that the platform imposes a hefty 26% processing fee. This means that as soon as you take out a loan, this percentage is already added. More importantly, late repayments automatically incur a penalty of 2% per day. Being late on payments could also get you banned on higher loan amounts. Other than that, there’s not much problem with the platform.

A good source of emergency funds

As far as online lending apps are concerned, MoKash delivers the same service as any other loan platform. The amount and payment terms are flexible, giving borrowers more options. While the processing time of two weeks is a bit longer, it makes up for it with easier registration requirements. Also, like most lending apps, get ready for the costs and penalties from late payments.